Expense management is a critical component of IT lifecycle management. Properly tracking and controlling expenses ensures that resources are allocated efficiently, reducing the risk of overspending and underutilization. For IT managers, effective expense management can lead to significant cost savings, improved financial planning, and better decision-making.

Like many other things about IT, expense management has many moving pieces that make it work effectively for any organization.

The Benefits of Expense Management

Efficient resource allocation is one of the vital components of expense management.

By monitoring expenses closely, IT managers can identify areas where resources are being wasted and reallocate them to more productive initiatives. This helps in optimizing the IT budget and ensures that the organization remains competitive in the market.

In addition to resource allocation, expense management also plays a crucial role in risk mitigation. Unexpected costs can arise at any stage of the IT lifecycle, and having a robust expense management system in place can help organizations prepare for and address these challenges proactively. This minimizes the impact of unforeseen expenses on the overall budget and helps maintain financial stability.

Effective expense management contributes to strategic decision-making. By providing a clear picture of the organization’s financial health, it enables IT professionals to make informed decisions about future investments and initiatives. Thanks to all of this, your organization can remain agile and adapt to changing market conditions.

Let’s explore expense management a little deeper and what it can look like for your organization.

IT Invoice Management Simplified

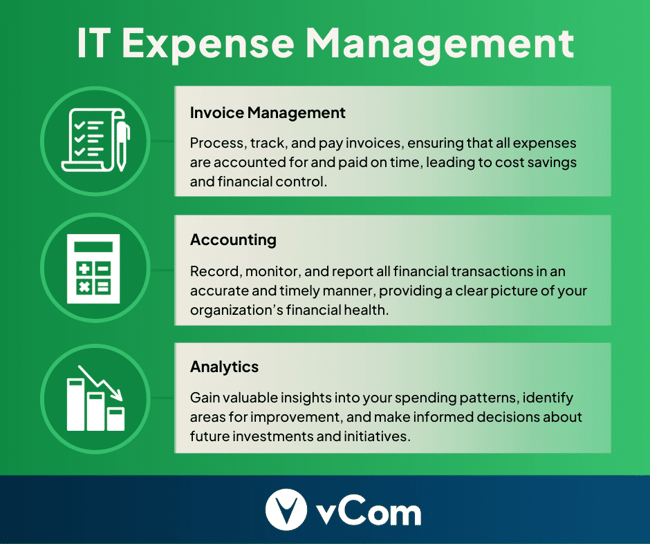

Invoice management is key for successful expense management in IT lifecycle management. It involves the systematic processing, tracking, and payment of invoices, ensuring that all expenses are accounted for and paid on time. Implementing an efficient invoice management system can lead to significant cost savings and improved financial control.

Invoice management is key for successful expense management in IT lifecycle management. It involves the systematic processing, tracking, and payment of invoices, ensuring that all expenses are accounted for and paid on time. Implementing an efficient invoice management system can lead to significant cost savings and improved financial control.

One of the primary benefits of invoice management is the reduction of manual errors. Manual invoice processing is prone to mistakes, which can lead to overpayments or missed payments. By automating the invoice management process, organizations can minimize these errors and ensure that all invoices are processed accurately and efficiently.

Timely payments are another advantage of efficient invoice management. Paying invoices on time not only helps maintain good relationships with vendors but also prevents late payment penalties and interest charges. This can result in significant cost savings and improved cash flow for the organization.

Invoice management can provide valuable insights into spending patterns and trends. By analyzing invoice data, you can identify areas where cost-cutting measures can be implemented and negotiate better deals with vendors. This helps in optimizing the IT budget and ensuring that resources are allocated effectively.

Streamlining IT Accounting Processes

Accurate and timely accounting ensures that all financial transactions are recorded, monitored, and reported, providing a clear picture of the organization’s financial health. Streamlining accounting processes can lead to improved financial control and better decision-making.

Accurate and timely accounting ensures that all financial transactions are recorded, monitored, and reported, providing a clear picture of the organization’s financial health. Streamlining accounting processes can lead to improved financial control and better decision-making.

One of the key benefits of streamlined accounting is enhanced financial visibility. By maintaining accurate and up-to-date financial records, organizations can monitor their expenses closely and identify potential issues before they escalate. This helps maintain financial stability and ensure that the organization remains on track to achieve its financial goals.

According to a report by PwC, companies that streamline their accounting processes can see a 36% reduction in financial close times.

Automation is another critical aspect of streamlining accounting processes. Automating routine tasks like data entry, reconciliation, and reporting, can help organizations reduce the risk of errors and free up valuable time for more strategic activities. This will improve the efficiency of the accounting team and create more financial data that is accurate and reliable.

The bottom line is that streamlined accounting processes can lead to better regulatory compliance. By maintaining accurate financial records and ensuring that all transactions are properly documented, organizations can meet regulatory requirements and avoid potential fines and penalties. This helps build trust with stakeholders and maintain a positive reputation in the market.

Leveraging IT Analytics for Better Decision-Making

Leveraging data and advanced analytics tools will help any organization gain valuable insights into their spending patterns, identify areas for improvement, and make informed decisions about future investments and initiatives.

Leveraging data and advanced analytics tools will help any organization gain valuable insights into their spending patterns, identify areas for improvement, and make informed decisions about future investments and initiatives.

Data-driven decision-making is one of the primary benefits of leveraging analytics. By analyzing financial data, IT managers can identify trends and patterns that can help optimize resource allocation and improve overall efficiency. McKinsey & Company found that data-driven organizations are 23 times more likely to acquire customers and 19 times more likely to be profitable.

Predictive analytics is another powerful tool that can be used in expense management. By analyzing historical data, organizations can predict future expenses and plan their budgets accordingly. This helps in minimizing the risk of unexpected costs and ensures that the organization remains financially stable.

Analytics can provide valuable insights into the effectiveness of cost-cutting measures and other initiatives. By monitoring the impact of these measures, organizations can identify areas where further improvements can be made and ensure that resources are being used effectively. This helps in optimizing the IT budget and maintaining financial control.

Implementing an Expense Management System

With all of this knowledge, it’s now time to implement an expense management system. A robust expense management system will help your organization track, control, and analyze its expenses, leading to improved financial planning and better decision-making.

Choosing the right expense management system is the first step in the implementation process. Organizations should consider factors such as ease of use, scalability, and integration with existing systems when selecting an expense management solution. A system that meets the organization’s needs and can be easily adopted by the team is key.

Training and support are also essential components of a successful implementation. Providing comprehensive training to employees ensures that they understand how to use the system effectively and can leverage its features to optimize expense management. Ongoing support helps address any issues that may arise and ensures that the system continues to meet the organization’s needs.

Regular monitoring and evaluation of the expense management system are crucial for its success. By continuously assessing the system’s performance and making necessary adjustments, organizations can ensure that it remains effective and provides valuable insights into their financial health.

Bringing [IT] All Together

Implementing an effective expense management system is essential for any organization looking to optimize its IT budget and ensure financial stability. By choosing the right solution, providing adequate training and support, and regularly monitoring performance, businesses can gain valuable insights into their financial health and make informed decisions. Ultimately, a well-executed expense management system leads to improved financial planning, better resource allocation, and enhanced overall efficiency.